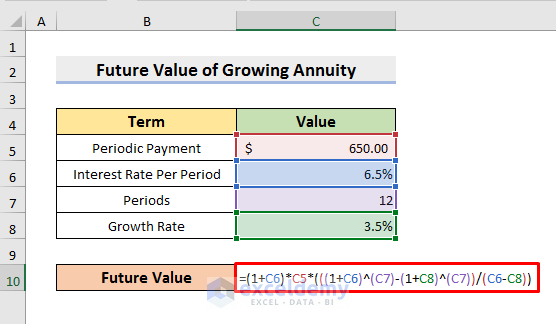

Growing annuity formula excel

Insert Formula for Growing Ordinary Annuity. In this equation the first payment C.

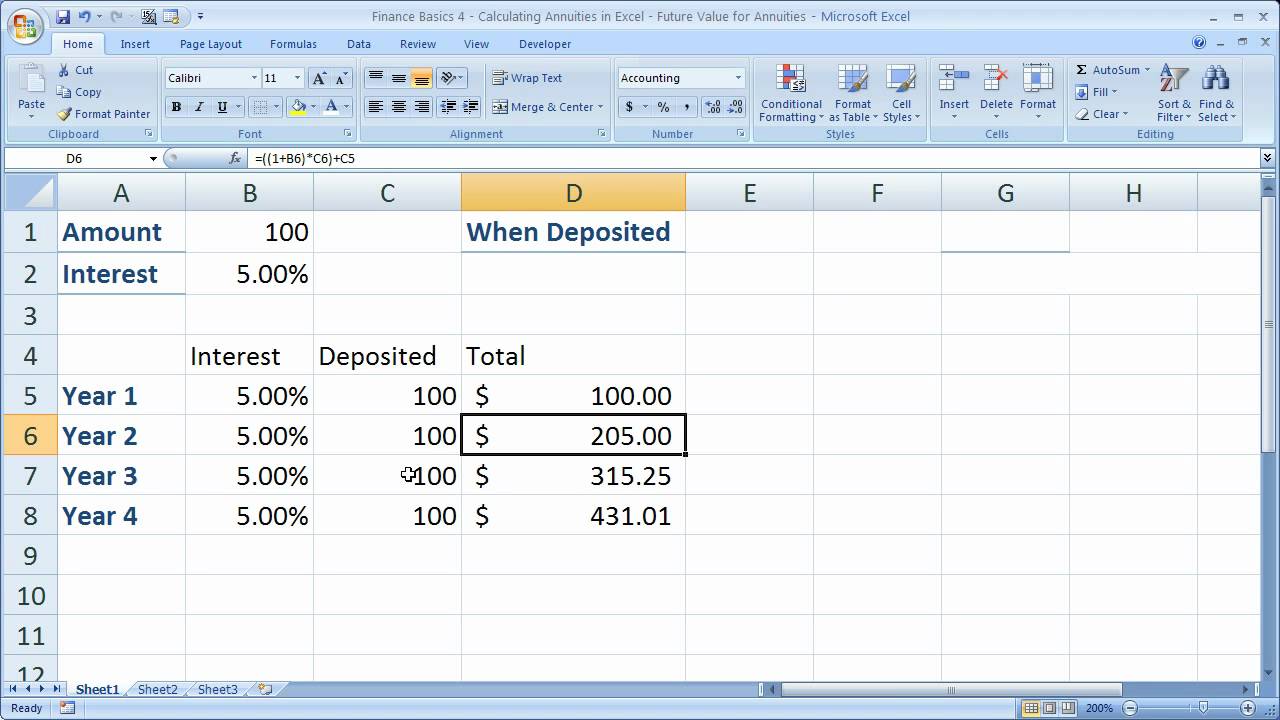

Finance Basics 4 Calculating Annuities In Excel Future Value For Annuities Youtube

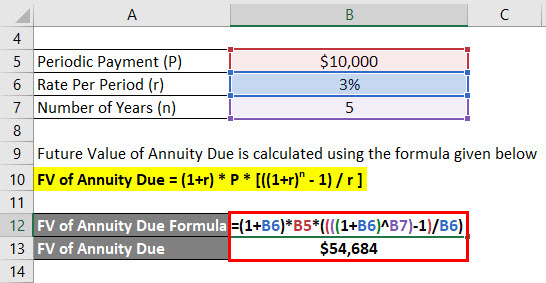

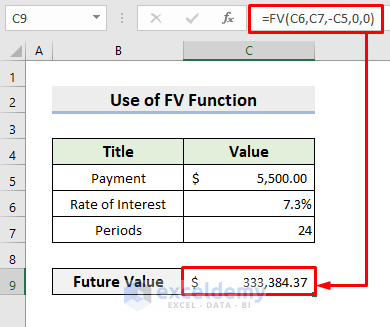

The formula for Future Value of an Annuity formula can be calculated by using the following steps.

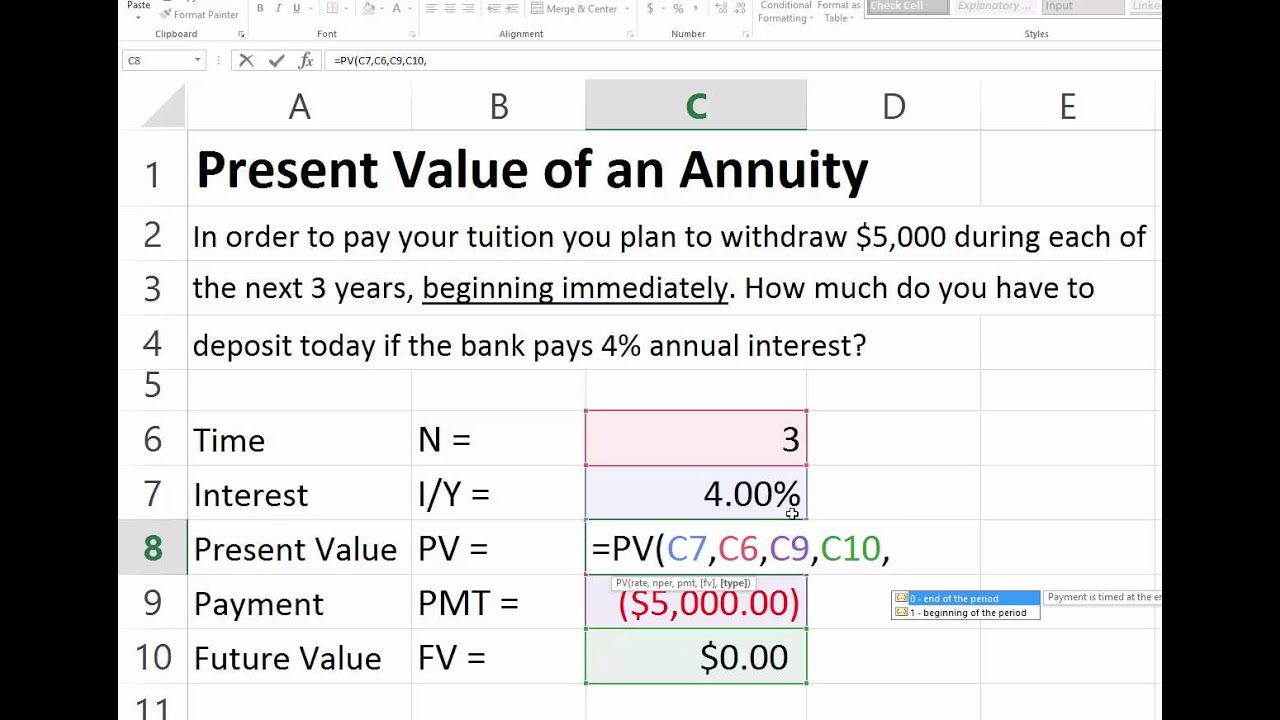

. By using the geometric series formula the present value of a growing annuity will be shown as. Firstly determine the nature of payments for annuity ie they should be paid at the beginning. Ad Learn More about How Annuities Work from Fidelity.

G Growth rate. Related Ar See more. Is the value of a current asset at a future date based on an assumed rate of growth over time.

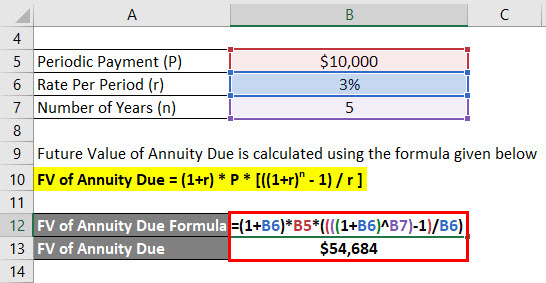

Calculate Future Value of Growing Annuity Due. Pv - from cell C4 0. N number of periods.

The future value of a growing annuity can easily be calculated by checking out all the cash flows individually. PV Present Value. Determine Future Value of Growing Ordinary Annuity.

R interest rate. Step-by-Step Procedures to Calculate Future Value of Growing Annuity in Excel. PMT is the amount of each payment.

N Number of periods. With an annuity due payments are made at the beginning of the period instead of the end. If you were trying to figure out the present.

Rate - from cell C6 5. I Discount rate. A represents the amount of periodic payment.

When you check the growing and initial cash flow at g make sure its sufficient. This formula can be simplified by multiplying it by 1r 1r which is to multiply it by 1. C cash value of the first payment.

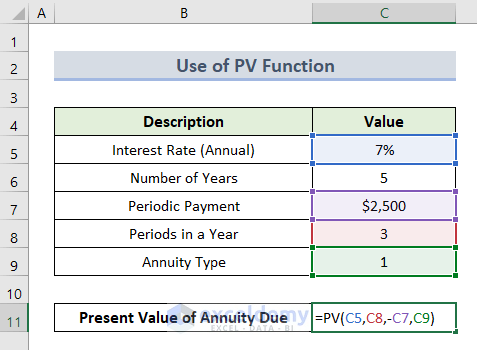

Pmt - from C7 5000 entered as negative value. Calculating the present value of an annuity using Microsoft Excel is a. Present Value of a Growing Annuity Formula.

The formula for Annuity Due can be calculated by using the following steps. Type - 0 payment at end of period regular annuity. G growth rate.

Firstly calculate the value of the future series of equal payments which. The basic annuity formula in Excel for present value is PV RATENPERPMT. A growing annuity is an annuity where the payments grow at a particular rate.

PMT Periodic payment. Where PV represents the present value of a perpetuity. You can also use the FV formula to calculate other annuities such as a loan where you know your fixed payments the interest rate charged and the number of payments.

For example assume that the initial payment is 100 and the payments are expected to grow each period at. Future Value of a Growing Annuity Formula. To calculate present value for an annuity due use 1 for the type argument.

Besides the present value of perpetuity can also be determined by the. Apply Formula for Growing Annuity Due. Fv - from cell C5 100000.

Ad Learn More about How Annuities Work from Fidelity.

Growing Annuity Formula With Calculator Nerd Counter

Future Value Of An Increasing Annuity Youtube

How To Calculate Future Value Of Growing Annuity In Excel

Excel Formula Future Value Of Annuity Exceljet

Finding The Present Value Of An Annuity Due In Excel Youtube

Future Value Of A Growing Annuity Formula Double Entry Bookkeeping

How To Apply Future Value Of An Annuity Formula In Excel

Graduated Annuities Using Excel Tvmcalcs Com

How To Calculate Future Value Of Growing Annuity In Excel

How To Apply Present Value Of Annuity Formula In Excel

Future Value Of Annuity Due Formula Calculator Excel Template

Graduated Annuities Using Excel Tvmcalcs Com

Present Value Of A Growing Annuity Calculator Double Entry Bookkeeping

Calculating Pv Of Annuity In Excel

Growing Annuity Formula With Calculator Nerd Counter

Present Value Of A Growing Annuity Formula With Calculator

Present Value Of A Growing Annuity Formula Double Entry Bookkeeping